EX-99.(A)(1)(H)

Published on November 13, 2007

Exhibit (a)(1)(H)

|

Tender Offer |

|

Tender Offer Information |

Logout

The Issue

The company recently performed a voluntary review of its stock option granting practices. The review revealed that certain stock option grants to employees were awarded at a discounted exercise price (i.e., the exercise price is less than the fair market value of the stock on the date of the grant). There can be adverse tax consequences involving such options.

Marvells Proposed Solution

The company is offering you the opportunity to have your eligible options amended and re-priced so that they will no longer have a discounted exercise price thereby avoiding the adverse tax consequences. This legal process is called a tender offer [see attached the Offer to Amend the Exercise price of Certain Options filed with the Security and Exchange Commission]. To compensate you for the difference in the new higher exercise price, the company will give you a right to receive Restricted Stock Units (RSUs) and/or a cash payment on the companys first payroll date in calendar year 2008.

To Participate in the Tender Offer via this Site, You Must...

1. Attend an informational meeting (details appear below; attached is the Discounted Stock Options and 409A Presentation) or review the employee presentation

2. Review your personal addendum

3. Review the Terms and Conditions of the Tender Offer

4. Submit a properly completed Election Form before 9:00 pm on Wednesday, December 12, 2007.

To participate in the tender offer, you must affirmatively elect to participate. If you do not, you will have rejected the offer and risk adverse tax consequences.

Informational Meetings and Other Support

So employees can completely understand the offer, the tax consequences, and other aspects of this program, live meetings are scheduled as follows:

Tuesday, November 13, 2007

Time: 10:00AM; and 2:00PM (all times Pacific Daylight Time)

Where: Building #5Santa Clara, CA

You may also attend these meetings remotely via webcast. The employee presentation materials are available on the left menu of this site. If you have questions about general tax information, you may submit your questions by clicking on the Ask a Question link on the menu or calling directly. Responses will come from an independent law firm that the company has engaged:

Glenn

A. Smith, Esq.

E-Mail: GlennSmith@TaxSensei.com

Phone: (650) 473-9501

9:00 am ~ 5:00 pm PST

http://www.taxsensei.com/

Please contact Stock Administration at AL- stockoption_exercise for questions related to stock option exercises. Please continue to contact AL-stockadmin for all other stock-related questions. This hotline should be used only for questions related to the penalty tax.

However, neither the company nor these law firms will provide tax advice specific to your individual circumstances or make any recommendations. If after reviewing all of the materials and asking any general questions, you feel you need further advice, we recommend that you seek the advice of a financial, legal and or tax advisors.

Remember, the deadline to accept the Tender Offer is 9:00 p.m., Pacific Daylight Time, on December 12, 2007.

Tender Offer FAQ

Outside Counsel Contact

Questions for U.S. employees will be answered by Glenn Smith, a professional corporation. The answers are not legal advice. This interaction is not intended to create, and does not constitute, an attorney-client relationship. You should not act upon any answers received without seeking your own counsel.

Frequently Asked Questions (*FAQ*)

The purpose of this FAQ is to provide you with information concerning certain changes in the federal income tax laws that may have an impact on certain stock options granted under Marvells stock option plan. For more information about which of your options may be affected by these changes in the tax laws, please contact Stock Administration.

1. How have the tax laws

changed?

A stock option penalty tax (Section 409A) was enacted in October 2004. Under

the laws, there are significant unfavorable tax effects to holding a stock option

with an exercise price that is less than the fair market value of the stock on

the original grant date (which we refer to as discount options). The penalty

tax only applies to discount options that vested after December 31, 2004.

2. Does Section 409A impact

Employee Stock Purchase Plan shares?

No, purchase rights under qualified Employee Stock Purchase Plans are exempt

from Section 409A

3. Does Section 409A impact

Incentive Stock Options?

Yes, discount options do not qualify as Incentive Stock Options (ISO).

Discount options are Non-qualified Stock Options (NQSO). Accordingly,

employment taxes, as well as federal and state income taxes on the difference

between your sales price (or fair market value on your exercise date, if a cash

exercise) and your option price are required to be withheld by Marvell at the

time you exercise.

4. What are the tax effects if I

exercised a discount option in 2005?

If you exercised a discount option in 2005, there are no additional tax

consequences with respect to that exercise under Section 409A. If there were

any employment and income taxes due as a result of the exercise of a NQSO,

Marvell has taken care of this with the Internal Revenue Service (IRS).

5. What are the tax effects if I

exercised a discount option in 2006?

If you exercised a discount option in 2006, you will generally be subject to

additional taxation on the difference between the fair market value on the

vesting date and the original grant price (the Spread). In addition to the

federal and state taxes ordinarily due on a NQSO exercise, the Spread will be

subject to a 20% federal tax plus interest when the options vest, and in

certain states, including California, an additional state tax plus interest.

This can raise your overall tax rate on these options to close to 90% depending

on where you live and your total taxable income.

If you were subject to an additional taxation because you exercised discounted options in 2006 you should have received an additional pay-stub on June 29, 2007. That special pay-stub means that Marvell entered into programs with the Internal Revenue Service and Californias Franchise Tax Board to pay these additional taxes on your behalf and you will not need to amend or correct your 2006 tax returns.

6. What are the tax effects if I

currently hold an unexercised discount option?

If you hold an unexercised discount option that vested after December 31, 2004,

and you do not correct it through the Tender Offer you could have total taxes

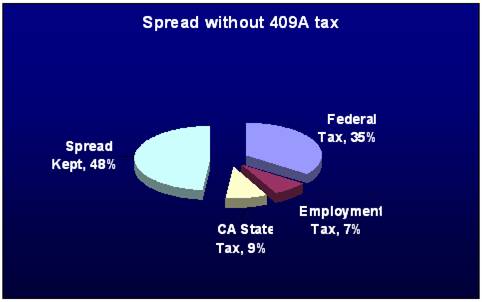

exceeding 90%. If the option were not discounted, normally, depending on your

tax circumstances, you could have expected to keep more than 45% of your

Spread.

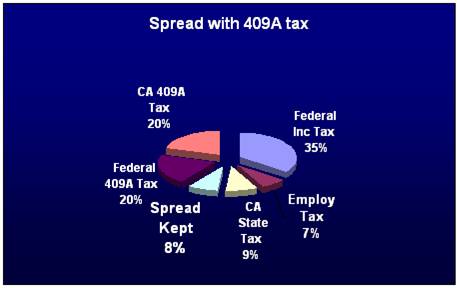

The application of the 409A tax means that the Spread is subject to a 20% federal tax plus interest when the options vest, and in certain states, including California, an additional state tax plus interest. This can raise your overall tax rate on these options to over 90% depending on where you live and your total taxable income. If these taxes were withheld, you would only be able to keep less than 10% of your Spread from your stock option exercise.

To protect you from accidentally exercising your discount options, you will not be able to use the internet to place a trade order, until and unless you have been cleared by Stock Administration. We know this is not ideal, but Marvell wants to make every effort to assist you with this complicated tax situation. Separate communications have been sent to you regarding the process for exercising your stock options. If you have any questions regarding the process and/or options you would like to exercise, please email Stock Administrations alias which is dedicated to responding to your questions and processing your exercises as quickly as is possible, AL-stockoption_exercise.

We strongly encourage you to consult your tax, financial, or other advisor to review your current situation and any decision you make.

7. What if I leave Marvell prior

to the completion of the alternatives?

If you leave Marvell prior to the completion of the offer, you will not be

eligible to participate in the offer. You will receive further details from

Marvell Human Resources and/or Marvell Stock Administration upon termination

with Marvell. We strongly encourage you to consult your tax, financial, or

other advisor regarding the tax consequences with respect to your options.

8. How do I know which stock

option grants were issued at a discount?

As stated above, a penalty tax applies only to discount options. You can

exercise your options that were issued at market value any time in accordance

with Marvells Insider Trading Policy. Stock Administration will provide you

with the list of all your options, including the details of your discount

options. You also can access this information in the Addendum you received in

connection with the offer.

9. What if I have additional

questions or need more information?

We will make available to you copies of this Q&A and other helpful

materials on the Stock Administration intranet site. We will also hold presentations

and open forums to answer your questions. We have established a hotline for you

to call, if you have further questions, specifically on the penalty tax:

Glenn

A. Smith, Esq.

E-Mail: GlennSmith@TaxSensei.com

Phone: (650) 473-9501

9:00 am ~ 5:00 pm PST

http://www.taxsensei.com/

Please note that the hotline will not have access to the information about which of your grants are and are not considered discount options, whether or not your shares are vested, nor will it have answers to any of your questions other than those specifically pertaining to 409A and the penalty tax. However, as always, you may direct your general stock-related questions to Marvell Stock Administration at AL-stockadmin. You may also direct exercise-specific questions to AL-stockoption_exercise. We will make every effort to assist you as quickly as we possibly can.

This summary of the tax consequences for participants who are subject to taxation in the United States is based on the legislation in effect as of November 2007.

|

Tender Offer Election Form |

|

Employee |

|

|

****@marvell.com |

|

|

Nov 12 2007 6:25PM |

Employee ID:**** |

Election

Please review the Election Agreement Terms & Conditions. You must review this document in order to make an election. Tender Offer Election Agreement Terms & Conditions Before completing this Election Form, please make sure that you have received, read and understand the documents that make up this offer, including:

Offer to Amend the Exercise Price of Certain Options (the Offer to Amend)

Email from Mike Rashkin, CFO, dated November 13, 2007

Tender Offer Election Agreement Terms & Conditions (the Election Form)

Employee presentations describing the Offer to Amend

Your personalized addendum containing information regarding your Eligible Options

Election

Please select the appropriate box below to indicate your acceptance or rejection of the offer. If you wish to participate in the offer, you must accept the offer with respect to all of your eligible options listed on your Addendum. Any attempt to accept the offer with respect to only a portion of your eligible options will be null and void.

(Selection Required)

o ACCEPT I have read the terms and conditions and wish to participate in the offer. If I have previously rejected the offer, this will act as a withdrawal of that rejection and I will participate in the offer.

o REJECT I wish to reject the offer. If I have previously accepted the offer, this will act as a withdrawal of that acceptance and I will not participate in the offer.

Addendum or Eligible Options

|

Option |

|

Option |

|

Shares |

|

Original |

|

New Exercise |

|

Increase in |

|

Aggregate |

|

||||

|

000TEST |

|

Nov 12,2007 |

|

1,234 |

|

$ |

27.105000 |

|

$ |

27.490000 |

|

$ |

0.385000 |

|

$ |

475.09 |

|

|

000TEST |

|

Nov 12,2007 |

|

1,098 |

|

$ |

9.475000 |

|

$ |

10.400000 |

|

$ |

0.925000 |

|

$ |

1,015.65 |

|

(1) The amount of RSUs to be granted, if any, cannot be determined until after the expiration of the tender offer. RSU grants are subject to your continued employment with Marvell through Marvells first payroll date in calendar year 2008

Terms and Conditions

![]()

1. I agree that my decision to accept or reject the Offer to Amend with respect to all of my eligible options is entirely voluntary and is subject to the terms and conditions of the Offer to Amend.

2. I agree and acknowledge that, if I submit an Election Form in which I have selected I REJECT, I have rejected the offer with respect to all of my eligible options and my eligible options may be subject to the adverse personal tax consequences described in the Offer to Amend.

3. I agree that, if prior to the expiration of the offer, I exercise my eligible options (or a portion thereof) with respect to which I have accepted the offer, such option(s) will no longer be eligible for amendment pursuant to the terms of the offer and I will not receive RSUs with respect to such option(s). Additionally, I acknowledge that the exercised options may be subject to adverse tax consequences.

4. I understand that I may change my election at any time by completing and submitting an Election Form before 9:00 p.m. (Pacific Daylight Time), on December 12, 2007 (unless the offer is otherwise extended) and that any Election Form submitted and/or received after such time will be void and of no further force and effect.

5. If my service with Marvell terminates prior to the expiration of the offer, I understand that I will cease to be an eligible employee under the terms of the Offer to Amend and any election that I have made prior to the termination of my employment to amend my eligible options will be ineffective. As a result, my eligible options will not be amended under the Offer to Amend and I will not receive any cash payment or RSUs.

6. I agree that decisions with respect to future grants under an Marvell employee stock plan, if any, will be at the sole discretion of Marvell.

7. I agree that: (i) the offer is discretionary in nature and may be suspended or terminated by Marvell, in accordance with the terms set forth in the Offer to Amend, at any time prior to the amendment of the eligible options; (ii) Marvell may, at its discretion, refuse to accept my election to participate; and (iii) the offer is a one-time offer which does not create any contractual or other right to receive future offers, options or benefits in lieu of offers.

8. I agree that: (i) the value of any RSU payments and participation in the offer made pursuant to the offer is an extraordinary item of income which is outside the scope of my employment contract, if any; (ii) the offer value of any RSU payments made pursuant to the offer is not part of normal or expected compensation for any purpose, including but not limited to purposes of calculating any severance, resignation, redundancy, end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments.

9. Neither my participation in the offer nor this Election Form shall be construed so as to grant me any right to remain in the employ of Marvell or any of its subsidiaries and shall not interfere with the ability of my current employer to

terminate my employment relationship at any time with or without cause (subject to the terms of my employment contract, if any)

10. For the exclusive purpose of implementing, administering and managing my participation in the offer, I hereby explicitly and unambiguously consent to the collection, receipt, use, retention and transfer, in electronic or other form, of my personal data as described in this document by and among, as applicable, my employer and Marvell and its subsidiaries I understand that Marvell and my employer hold certain personal information about me, including, but not limited to, my name, home address and telephone number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or directorships held in Marvell, details of all options or any other entitlement to shares of stock awarded, canceled, exercised, vested, unvested or outstanding in my favor, for the purpose of implementing, administering and managing the offer (Data). I understand that Data may be transferred to any third parties assisting in the implementation, administration and management of the offer, that these recipients may be located in my country or elsewhere, and that the recipients country may have different data privacy laws and protections than my country. I understand that I may request a list with the names and addresses of any potential recipients of the Data by contacting my local human resources department representative. I authorize the recipients to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing my participation in the offer. I understand that Data will be held only as long as is necessary to implement, administer and manage my participation in the offer. I understand that I may, at any time, view Data, request additional information about the storage and processing of Data, require any necessary amendments to Data or refuse or withdraw the consents herein, in any case without cost, by contacting in writing my local human resources department representative. I understand, however, that refusing or withdrawing my consent may affect my ability to participate in the offer. For more information on the consequences of my refusal to consent or withdrawal of consent, I understand that I may contact my local human resources department representative.

11. Regardless of any action that Marvell or a subsidiary of Marvell takes with respect to any or all income tax, social insurance, payroll tax or other tax-related withholding related to the offer (Applicable Withholdings), I acknowledge that the ultimate liability for all Applicable Withholdings is and remains my sole responsibility. In that regard, I authorize Marvell and/or its subsidiaries to withhold all Applicable Withholdings legally payable by me from my wages or other cash payment paid to me by Marvell and/or its subsidiaries. Finally, I agree to pay to Marvell or its subsidiary any amount of Applicable Withholdings that Marvell or its subsidiary may be required to withhold as a result of my participation in the offer if Marvell does not satisfy the Applicable Withholding through other means.

12. I acknowledge that I may be accepting part or all of the offer and the terms and conditions of this Election Form in English and I agree to be bound accordingly.

13. I acknowledge and agree that none of Marvell, Glenn Smith, a professional corporation, or any of their respective employees or agents, has made any recommendation to me as to whether or not I should accept the Offer to Amend my Eligible Options and that I am not relying on any information or representation made by any such person in accepting or rejecting the Offer to Amend, other than any information contained in the Offering Documents.

14. I agree that participation in the offer is governed by the terms and conditions set forth in the Offer Documents and this Election Form. I have received the Offer Documents and have been afforded the opportunity to consult with my own investment, legal and/or tax advisors before making this election and that I have knowingly accepted or rejected the offer. I agree to accept as binding, conclusive and final all decisions or interpretations of Marvell upon any questions relating to the offer and this Election Form.

15. I further understand that Marvell intends to send me an Election Confirmation Statement via email at my Marvell email address within two business days after the submission of my Election Form. If I have not received such an e-mail confirmation, I understand that it is my responsibility to ensure that my Election Form has been received before 9:00 p.m. (Pacific Daylight Time), on December 12, 2007. I understand that only responses that are complete, signed (electronically or otherwise) and actually received by Marvell by the deadline will be accepted.

|

RSU Calculator |

Estimate the number of RSUs you will receive, based on a hypothetical market value.

|

Employee |

|

|

|

****@marvell.com |

|

|

|

Nov 12 2007 6:21PM |

|

Employee ID:**** |

|

Option |

|

Orig.

Exercise |

|

New

Exercise Price per |

|

Shares

Subject to |

|

# of RSUs |

|

||

|

000TEST |

|

$ |

27.105000 |

|

$ |

27.490000 |

|

1,234 |

|

|

|

|

000TEST |

|

$ |

9.475000 |

|

$ |

10.400000 |

|

1,098 |

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Total: |

|

||

Stock FMV: ![]()