PRESENTATION MATERIALS

Published on December 16, 2008

Marvell Confidential © 2008 Stock Option Exchange Program Education Session Presenter December __, 2008 Exhibit (a)(1)(I) |

2 Marvell Confidential © 2008 Introduction Marvell filed Tender Offer documents on Tuesday, December 16, 2008 with the SEC to open a stock option exchange program for eligible employees Why is Marvell doing this? Stock options are intended to align employee interests with shareholders and support employee retention Due to a market downturn and other macro-economic factors, many of our employees stock options are underwater (i.e., have per share exercise prices substantially higher than the current trading price of Marvells common stock) Management and the Board of Directors would like to restore the incentive and retention benefits of selected equity awards This presentation will provide details of the tender offer process associated with the exchange and explain how eligible employees can participate |

3 Marvell Confidential © 2008 Topics Covered Eligibility How will the tender offer work? If I participate, what happens to my Options? How do I participate? What happens if I do not participate? Important Disclosures |

4 Marvell Confidential © 2008 Eligibility: Who can participate and which Options are affected? Active Employee You must be actively employed by Marvell at the start and at the end of the tender offer Executive officers and members of the board of directors are not eligible for this program Plan Limitation - Only Options granted under the Marvell 1995 Stock Option Plan are eligible for the exchange Exercise Price Limitation - Only Options with a per share exercise price of at LEAST $12.00 per share are eligible. This measurement is done on a grant by grant basis |

5 Marvell Confidential © 2008 How will the tender offer work? Definition: An offer by Marvell to eligible employees to tender their stock options during a specified time in exchange for a specified number of restricted stock units (RSUs) based on predetermined exchange ratios (or cash when RSUs to be received are RSUs less than or equal to 150 shares) By replacing the equity awards that have exercise prices substantially higher than the current stock price with RSUs, the employee now has something which will always have value in exchange for something that likely had little or no value without a substantial increase in the stock price As the tender offer only applies to certain stock options, each employee may have some awards that are eligible and other awards that are not eligible for the program Exchanged options are on a grant by grant basis Employees are not required to participate in the tender offer |

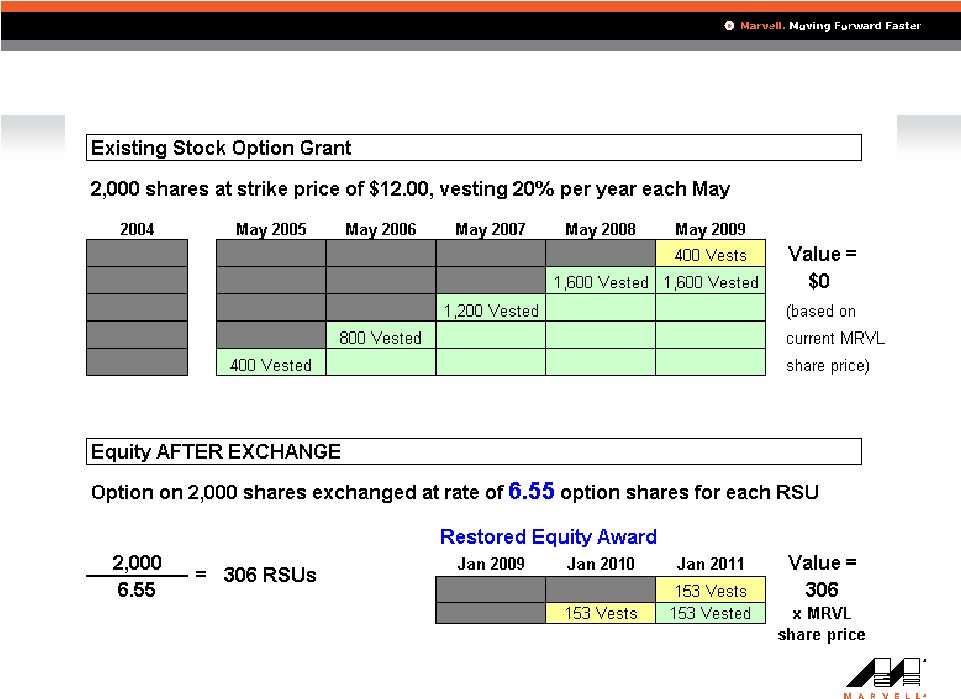

6 Marvell Confidential © 2008 If I participate, what happens to my Options? Tendered Options are Cancelled - Those options that you tender in exchange for RSUs will be cancelled New RSUs Granted - Upon the completion of the tender offer, if you are an active employee, you will receive a certain amount of new RSUs based on an exchange ratio as defined in the tender offer document. The higher the exercise price of the stock option, the more options which will be required to be tendered for each RSU RSUs Subject to Vesting - The RSUs to be issued in connection with the tender offer will contain vesting provisions determined based on the percentage of shares vested of the tendered options: No new RSUs will be vested on the date of grant January 23, 2009* If 75% or greater of the shares are vested of the tendered option at the end of the tender offer the new RSUs will vest over 2 years (50% on each anniversary of January 23, 2009) If less than 75% is vested the new RSUs will vest over 3 years (33% on each 1 yr anniversary of January 23, 2009) Employees with four (4) year cliff vesting in which 75% or greater of the time has elapsed since the grant will receive two (2) year vesting * (unless you are an eligible employee in Canada, the Netherlands or Israel and vesting of a portion of your RSUs maybe necessary to cover a portion of your tax liability at grant or upon exchange) Cash out for small RSU amounts - If the number of RSUs to be received for any option grant is less than or equal to 150 shares, you will receive cash instead of RSUs. The cash payment will be made through payroll |

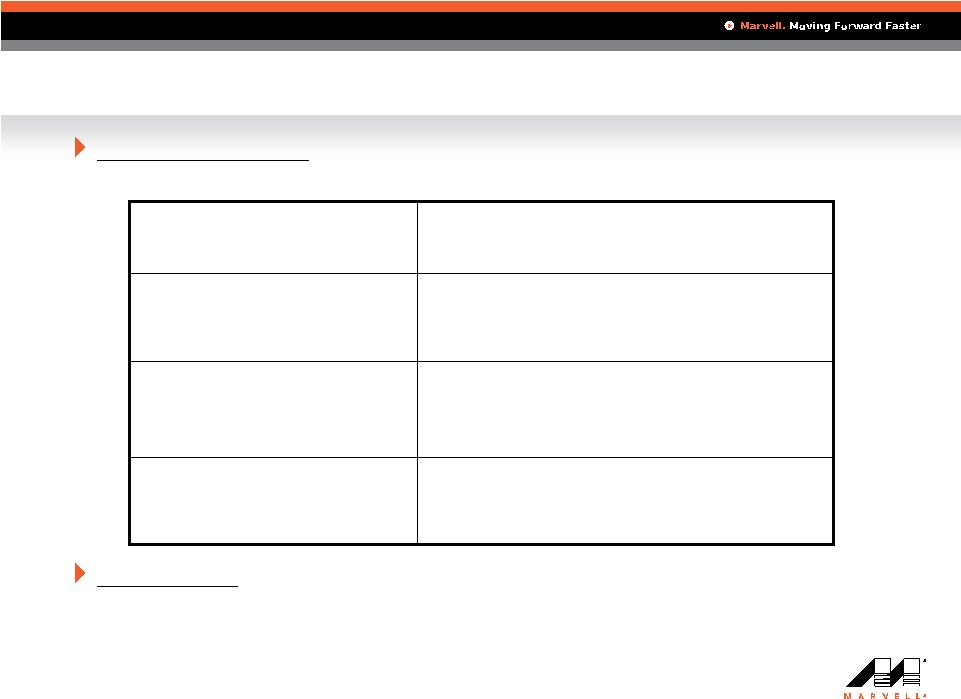

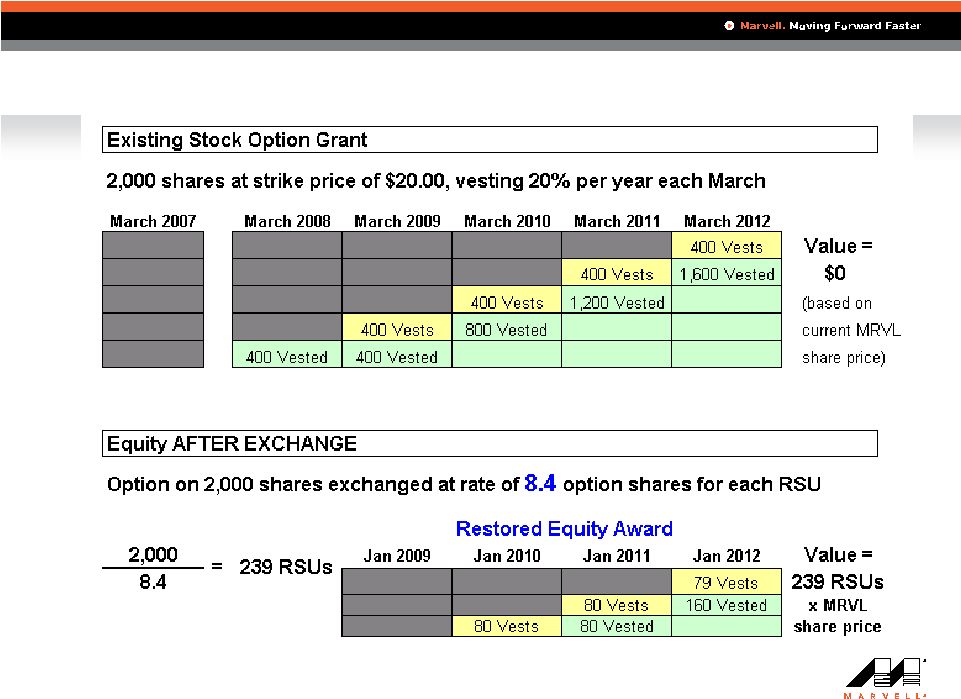

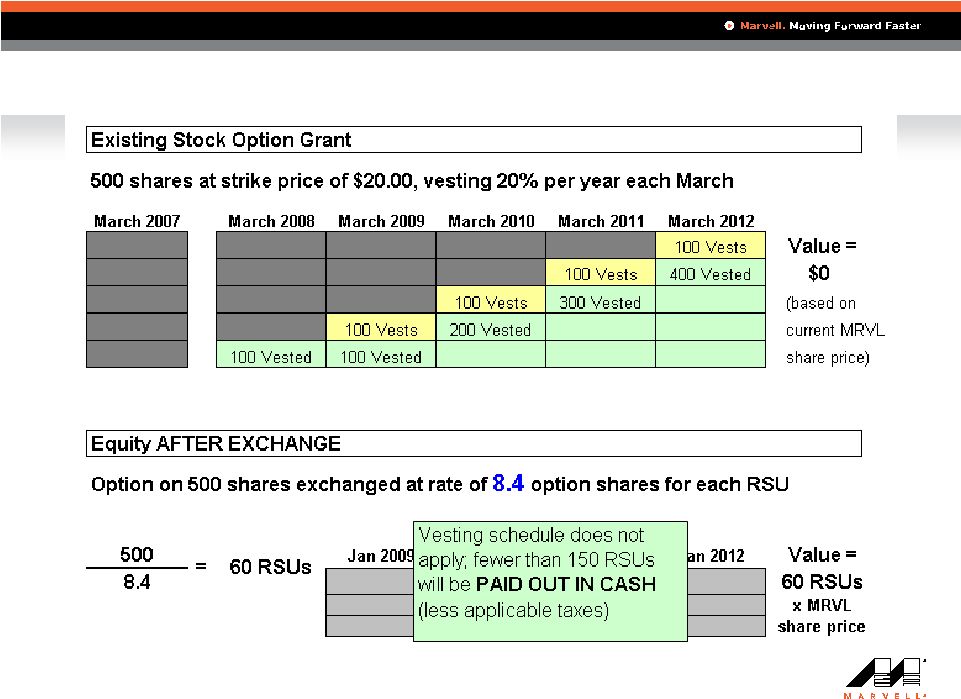

7 Marvell Confidential © 2008 Sample RSU Calculations Number of RSUs - The number of RSUs that you receive will depend on the exercise price of your exchanged options Please note: The exchange ratios apply to each of your award grants separately. This means that the various eligible options you hold may be subject to different exchange ratios One (1) restricted stock unit for every thirteen point two (13.2) exchanged options $25.01 and higher One (1) restricted stock unit for every eight point four (8.4) exchanged options $18.01 - $25.00 One (1) restricted stock unit for every six point five five (6.55) exchanged options $12.00 - $18.00 Restricted Stock Units for Exchanged Options Per Share Exercise Price of Eligible Option |

8 Marvell Confidential © 2008 Sample Calculation #1 (2 year vesting example) |

9 Marvell Confidential © 2008 Sample Calculation #2 (3 year vesting example) |

10 Marvell Confidential © 2008 Sample Calculation #3 (Cash example) |

11 Marvell Confidential © 2008 How do I participate? Visit the Tender Offer Website On your browser URL line type: https://tenderoffer.marvell.com/ You will next be prompted to provide MS Windows login name and password [user name and password are case-sensitive] Marvell Windows Login Name: janesmith Marvell Windows Password: 1234 Marvell Payroll# (Employee ID): test2 After completing the online election form and exiting the site, you will receive a confirmation from stockadmin@marvell.com thru your Marvell e-mail. A written confirmation will be mailed out to employees who do not have access to the website You MUST be an employee at the start of the tender offer through the end of the tender offer To participate in the tender offer, you must affirmatively elect to participate. If you do not elect to participate, you will have rejected the offer and your options will remain the same |

12 Marvell Confidential © 2008 Website Screen Shots [Picture of Webiste Pages] |

13 Marvell Confidential © 2008 How do I participate? (cont) Alternatively, you may submit your election form via fax by doing the following: Visit the tender offer website Print an election form, including the election form terms and conditions Properly complete the election form (including dating and signing the election form) Fax the properly completed election form to Marvell Stock Administration at the fax number: (408) 222-9300. Marvell must receive your properly completed and submitted election form before 6:00 p.m. Pacific Time, on January 23, 2009 If you are unable to print your election form from Marvells tender offer website, you may e-mail stockadmin@marvell.com to receive a paper election form You may also request copies of the tender offer documents by sending an email to stockadmin@marvell.com or calling Marvell Stock Administration at (408) 222-8436 |

14 Marvell Confidential © 2008 Tender Offer Time Line SEC requires tender offer to be open for at least 20 business days once it begins Begins on Tuesday, December 16, 2008 Closes at 6:00 pm on Friday, January 23, 2009 At the end of the tender offer period, the tendered options will be cancelled and RSUs will be granted shortly thereafter no grant occurs before the tender offer closes Employees planning vacations or leaves of absence during the tender offer period should make arrangements to participate BEFORE you leave keep close contact with Marvell email account for any updates from stockadmin@marvell.com for all matters related to the tender offer tender offer closes at 6:00 pm on Friday, January 23, 2009, NO LATE SUBMISSION WILL BE ACCEPTED! |

15 Marvell Confidential © 2008 What happens if I do not participate? Your Options are unaffected - You will continue to hold the same options as before with the same exercise price per share; and subject to the original vesting schedule |

16 Marvell Confidential © 2008 Important Disclosures You will be provided with a link to the tender offer documents and related documentation. Please review it CAREFULLY before deciding to make your election. You may also request copies of the tender offer documents by sending an email to stockadmin@marvell.com or calling Marvell Stock Administration at (408) 222-8436 Taxation of stock option transactions can be very complicated and the rules vary country by country Company policy prohibits any employees from providing personal income tax advice to any other employee This presentation is general and you should consult with your personal tax advisor for advice relevant to your specific situation |

17 Marvell Confidential © 2008 Disclaimer THIS PRESENTATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT AN OFFER TO PURCHASE OR THE SOLICITATION OF AN OFFER TO SELL ANY SECURITIES. A SOLICITATION WILL BE MADE ONLY PURSUANT TO AN TENDER OFFER AND RELATED MATERIALS THAT MARVELL TECHNOLOGY GROUP LTD. WILL FILE WITH THE SECURITIES AND EXCHANGE COMMISSION ("SEC") AS PART OF A TENDER OFFER. OPTION HOLDERS WHO WILL BE ELIGIBLE TO PARTICIPATE IN THE TENDER OFFER SHOULD READ THE FILED MATERIALS CAREFULLY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE OFFER TO EXCHANGE. OPTION HOLDERS WILL BE ABLE TO OBTAIN TENDER OFFER MATERIALS FREE OF CHARGE FROM THE SEC'S WEBSITE AT WWW.SEC.GOV OR FROM MARVELL TECHNOLOGY GROUP LTD. |